Ludhiana 24 July

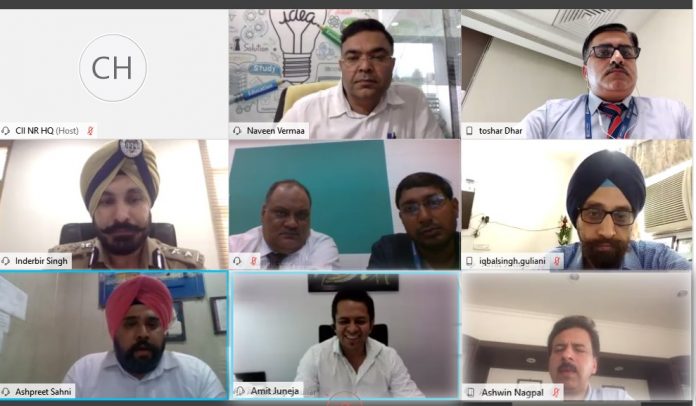

Confederation of Indian Industry (CII) organized a session on Cyber Security through a virtual platform in association with HDFC Bank Ltd here today. During the webinar, Mr. Inderbir Singh, AIG – Cyber Crime Punjab Police apprised the industry members regarding different Cyber Safety Tips (along with his Cyber Team DSP Mr. Samarpal Singh and Sub Inspector Mr. Gaganpreet Singh) to secure the devices linked to the Internet, so that hackers may not steal the confidential data and hard-earned money lying in a bank account by cracking passwords. Mr. Inderbir Singhsaid, “In the current scenario, every task is being done through online systems like Internet Banking, Online Studies, Use of Credit Cards/Debit Cards, etc. So, there are many ways by which hackers can connect with your device and get the required info. So, please don’t get panic if you receive any harmful communication and Don’t delete that communications (emails, chat logs, posts, etc). These may help provide vital information about the identity of the person behind these. Please avoid getting into huge arguments online during chat or discussions with other users because all other internet users are strangers. So, be careful as you do not know who you are chatting with and don’t share your personal information.”

Mr. Singh said that for the safety of Children do not give out identifying information such as Name, Home address, School Name, or Telephone number in a chat room. Do not send your photograph to anyone on the Net without first checking with your parents or guardians. Do not respond to messages or bulletin board items that are suggestive, obscene, belligerent, or threatening. Never arrange a face-to-face meeting without telling parents or guardians. Remember that people online may not be who they seem to be. Parents are advised to use content filtering software on the PC to protect children from pornography, gambling, hate speech, drugs, and alcohol. There is also software to establish time controls for individual users (for example blocking usage after a particular time at night) and log surfing activities allowing parents to see which site the child has visited. Use this software to keep track of the activities of your children.

Mr Inderbir Singh gave some suggestions for safety & security like:

- Do not keep computers online when not in use. Either shut them off or physically disconnect them from an Internet connection.

- Use strong passwords: Choose passwords that are difficult or impossible to guess. Give different passwords to all other accounts. Do not give your password to anybody. Somebody who is malicious can cause great harm to you and your reputation. It is like leaving your house open for a stranger and walking away.

- Make regular back-up of critical data. Back-up must be made at least once in each day. Larger organizations should perform a full back-up weekly and incremental back-up every day. At least once in a month, the back-up media should be verified.

- Use virus protection That means three things: having it on your computer in the first place, checking daily for new virus signature updates, and then actually scanning all the files on your computer periodically.

- Use a firewall as a gatekeeper between your computer and the Internet. Firewalls are usually software products. They are essential for those who keep their computers online through the popular DSL and cable modem connections but they are also valuable for those who still dial-in.

- When talking to somebody new on the net, do not give away personal information-like numbers of the credit card used by you, your home addresses/ phone numbers, and such other personal information.

- Always dispose-off the information about yourself properly so that it cannot be stolen by hackers like Boarding Pass or anything having QR code etc.

Mr. Iqbal Singh Guliani, Zonal Head & SVP – HDFC Bank Ltd also updated the industry members regarding secured banking solutions. Mr. Guliani apprised the participants about securing of Bank accounts, Credit Card/ Debit Cards, ATM Phishing, etc. Every user should be cautious while operating Debit Card/Credit Card as hackers may check the password during your use on machines. Hackers may ask about the OTP for getting into your bank accounts. So, please don’t share OTP with anyone.

Mr. TosharDhar, Regional Head & VP – Risk Intelligence & Control – HDFC Bank Ltd.also confirmed about safety tips regarding debit/credit card cloning, phishing through online banking, and fake apps through which the hackers can steal money. Mr. Dhar apprised about digital skimming by which Fraudsters place malicious code on the websites to skims the financial information of the user. One should not click on the unknown link received on the device else And for any suspicious transaction in the HDFC bank account, the account holder can contact on 61606161 to register a complaint.

Mr. Amit Juneja, Chairman – CII Ludhiana Zonal Council said, “Technology, an inevitable discussion of pros and cons in the last decade, has turned out to be a savior of the economy, a blessing to mankind, and a safe shelter for our existence in the last few months. While the entire world is trying to find order in chaos and adapt to the change in challenging COVID-19 times. A major chunk of prevailing sanity we owe to the technological era that we live in. From keeping people aware of running daily lives, all is being dealt with by Artificial Intelligence. In today’s digital world, effective cybersecurity is a crucial business success factor. As hackers find more ways to attack digital assets, the capability of an enterprise to maintain business continuity, and the security of the critical data in it, maybe called into question. New threat vectors and attack techniques demand new approaches to corporate protection. In lieu of this, CII has organized such an awareness session for the benefit of all, to make our devices and hard-earned money secured from the hackers.”

In this exclusive webinar, more than 270 participants registered to get the vital information shared by different panelists.