Gst : death knell for small traders and karigar’s in india when most of the population is illiterate, how do you expect us to move at modi’s pace? This is our question to the government.

Most of work on fabrics, hand and machine in india, is done by the millions of people working from their homes, both men and women in villages and small towns. It is the most secure way for women to earn from the comfort of their family home and they don’t even need education but just skills that have been passed down and perfected over the years. In this non-polluting cottage industry, they often earn their livelihoods by working on a single piece for months at a stretch. So why are you killing my artisans and karigars in the name of gst .

It will be absolutely impossible to expect all our vendors (small karigars) to register and file 3 monthly returns every month and if they don’t file their gstr1, we will not get our claims so it’s going to be utter chaos.

What will u do if your karigar charges you 5% gst and doesn’t upload on his return on time? We will not be able to claim our itc.. So our dependency on small karigars to file their own returns on time will be of a major concern.

Another important observation is that even for those vendors who are below 20 lakh turnover, need to register & pay gst if they want to do interstate transactions.

Since large amount our work is done on fabrics from outside the state example if a karigar from lucknow who is selling you ready material in ludhina , with a small turnover, even he won’t be able to avail the advantage .. Which is not justified.

The law proposed is this that job work can be done by gst registered vendor only. Only exception is this that if the vendor is doing work for less than 20 lacs in a year, he may remain unregistered but on 2 conditions;

1. We will have to take guarantee that the job worker is not doing business for more than 20 lacs in total in a year and that too after we get a special written permission from the gst commissioner.

2. In case the job worker is doing business for less than 20 lacs in a year, we will have to show his name and address as *our other place of business* in our registration certificate.

That implies we will miss on input if we deal with unregistered party. As it is practically impossible for thousands of small time traders , shop keepers and karigar’s who are have no infrastructure and education to meet up with gst compliance.

With the new laws and penalty’s and panelisation in place from 1 st of july 2017 it’s the end of the road for the small businesses.

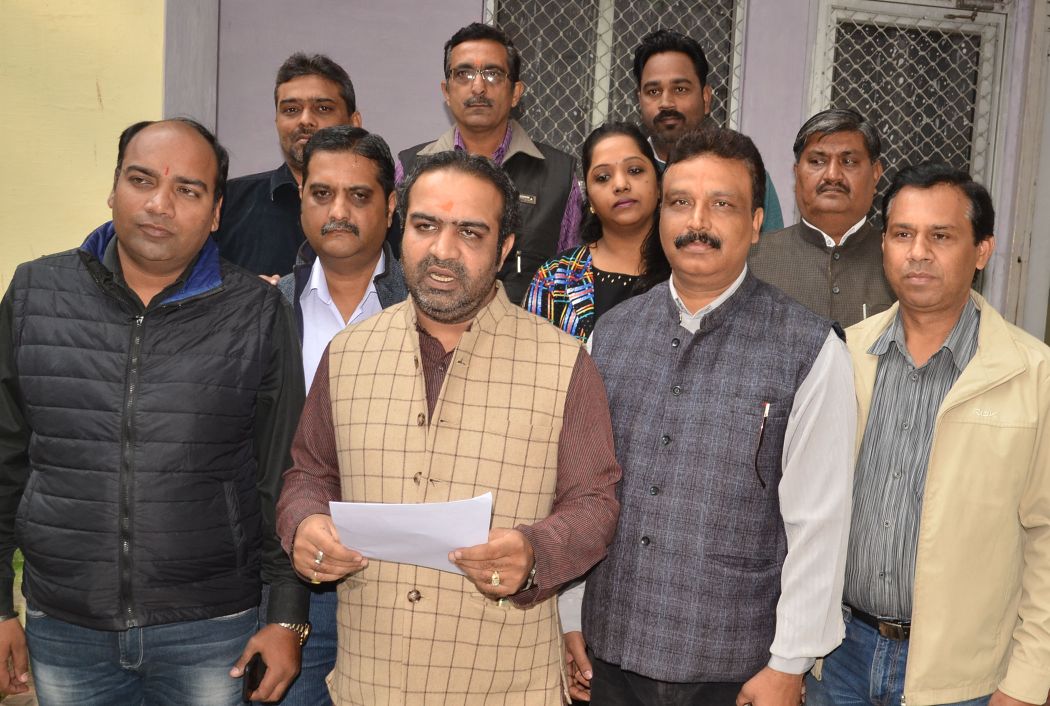

This resentment is beign shown in form of complete shut down of showrooms and wholesale markets across punjab.

We stand with our fellow textile merchants across india for “0 % gst on textiles Therefore our humble pray to the finance ministry to relook into serious matter again and roll back proposed 5 % gst on textiles