Now Common Man To Get Less Interest; Centre Slashes Interest Rates On Small Savings

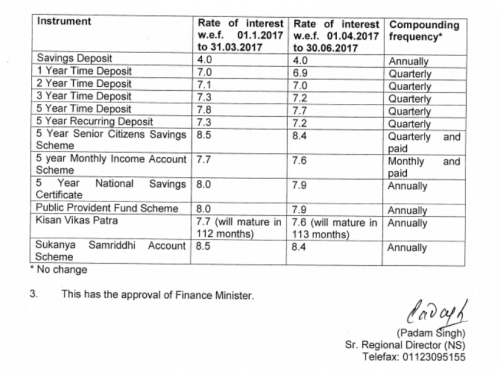

The Centre on Friday slashed interest rates on small savings schemes across the board by 10 basis points (0.1 percent) to bring them on par with market rates – a move that may prompt commercial banks to slash rates in the absence of policy rate cuts by the Reserve Bank of India (RBI).

The new rates will be effective for the quarter April-June 2017 and the decision has been taken so as to align small saving interest rates with yields on government bonds.

The only interest rate that remains unchanged is savings deposits which stays put at 4.0 percent.

However, the largely popular Public Provident Fund (PPF) is at 40-year low, fetching an interest of 7.9 percent per annum for the April-June 2017 quarter, in contrast to the 8.0 percent of the previous quarter. The Kisan Vikas Patra (KVS) would now earn 7.6 percent, the 5-year senior citizens savings scheme would earn 8.4 percent, while Sukanya Samridhi Yojana, the scheme which aims to uplift the girl child, will also earn 8.4 percent interest.

After his demonetisation move, PM Modi had assured the general public on 31 December 2016 (the day banks returned to normalcy) that senior citizens would earn a fixed interest of 8 percent on bank deposits upto 7.5 lakh for 10 years, which would be paid monthly. However, this is yet to be implemented.

As reported by Times Now, Bandhan Bank Managing Director Chandra Shekhar Ghosh said, “Credit growth is at a historical low (after demonetisation). Banks have no alternative but to cut deposit rates as they have lesser opportunity to deploy the fund.”

Many banks including the State-run Bank of India, SBI, Bank of Baroda, ICICI, HDFC bank have been lowering rates to make deposits less attractive.

The rates have been revised to align small savings rates to government bonds – a highly insensitive move by the centre as both the deposit schemes are contrastingly different from each other. While the earnings on government bonds fluctuate according to the government’s monetary and fiscal policy, as well as numerous other global factors like the US bank rates, small savings interest rates are encouraged to foster the savings habit on the common man and provide him with modest returns.

With a slash in the interest rate, the government is penalising the public for its own faults. The large in-flow of cash due to demonetisation has left banks overflowing with money, and to facilitate smooth credit, banks demand low short-term interest rates.

The government has put the burden of its fault on the shoulder of the citizens. It is not the 0.1 percent slash that should matter here, but the fact that the government can freely victimise its citizens who neither participate nor have any control over the workings of government bonds. The move undermines the common man’s trust on its government.

Also read: Interest Rates Slashed For PPF & Other Important Schemes, People To Get Less Returns As A Consequence

Govt. Clarifies EPF Provision: Only The Interest Will Be Taxed, Not The Principal Amount