HIGHLIGHTS

- SBI has removed charges for account closure in few cases

- The bank revised the monthly average balance (MAB) requirement too

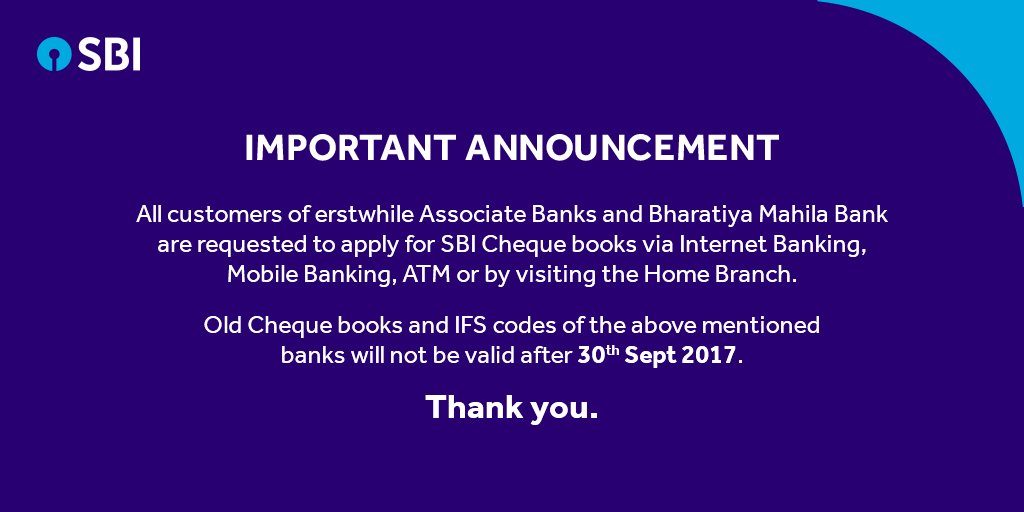

- Customers of SBI’s 6 associate banks also need to avail new cheque books

From October 1 onwards, customers of SBI savings account will pay lower charges for not maintaining minimum average balance. SBI has also removed charges for account closure in some cases. Also, old cheques of SBI’s associate banks, which were merged with SBI, stands invalid from October 1. Earlier, SBI in a Twitter post had said that account holders of State Bank of Patiala, State Bank of Bikaner and Jaipur, State Bank of Raipur, State Bank of Travancore, State Bank of Hyderabad and Bhartiya Mahila Bank will have to apply for the new cheque books. Old IFS codes of the associate bank branches will also be invalid.

Earlier, if you closed a savings account in SBI after one year of opening it, it used to attract a charge of Rs. 500 plus GST. But from October 1, there will be nil charges for this service, SBI said in a twitter post.

SBI also reduced the monthly average balance (MAB) requirement for metro cities – from Rs.5,000 to Rs. 3,000 – and slashed charges for non-maintenance of minimum balance by up to 50 per cent effective today. SBI further said that savings accounts of pensioners, beneficiaries of social benefits from the government and the accounts of minors will be exempt from maintaining monthly average balance from today.

For urban branch accounts also SBI has cut the charges for non-maintenance of monthly average balance to Rs. 30-Rs. 50, from Rs. 40-Rs. 80 earlier. SBI has also reduced charges for non-maintenance of minimum balance in semi-urban and rural accounts to Rs. 20-Rs. 40. Earlier, SBI charged between Rs. 25 and Rs. 75 for semi-urban account and Rs. 20-Rs. 50 for rural accounts.

The monthly average balance requirement for other three categories of accounts – urban, semi-urban and rural branches – stands unchanged at Rs. 3,000, Rs. 2,000 and Rs. 1,000 respectively, according to SBI.