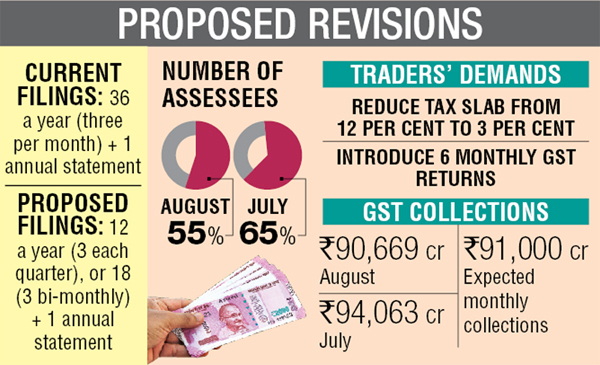

Facing increasing resistance from taxpayers, the Centre is considering cutting the number of GST statements to be filed from 36 in a year by a third, to only 12. Currently, GST payers must file three statements for each month (GSTR 1, GSTR 2 and GSTR 3), in addition to an annual statement.

“Two proposals are under active consideration —one is filing of three statements for a quarter while another is filing of three statements on a bi-monthly basis. In addition to this, taxpayer will file an annual statment. This is expected to provide relief to the tax payers,” a member of the GST council, said on condition of anonymity because of the ongoing deliberations.

This member added that states’ opinions on the matter are being sought, and a decision is expected in the GST Council meeting of October 6.

Ajit Joshi, a leading Mumbai-based chartered accountant, said businesses are spending a lot of their productive time, energies and money in the GST compliance due to failing servers, software compatibility issues and lack of clarity from the government.

“GST Council may extend filing of return to bi-monthly. Further, IT experts can confirm that there is no real requirement of filing the different statements for input output and all can be clubbed in a single form,” he said.

The Federation of Retail Traders Welfare Association president Viren Shah said the government needs to rework the GST slabs to a 3-12 per cent range. The government should also introduce six GST statements, which will release blocked funds.

The trigger for the government’s move is representations made by various business and trade bodies, as well as by state units to BJP national president Amit Shah and Finance Minister Arun Jaitley at the recently concluded party executive meeting.

The government collected Rs 90,669 crore in GST for August, slightly lower than the Rs 94,063 crore collected in July. The August collections are also lower than the Rs 91,000 crore per month expected to reach the Centre and states. However, only 55 per cent of assessees paid taxes for August, compared to 64 per cent for July.

The government had earlier extended the last dates for filing GSTR 1, 2 and 3 returns for July to October 10, 31 and November 10, respectively, following technical glitches at Goods and Services Tax Network (GSTN), the company that manages the GST IT infrastructure.