- Though the good news on Bank of India’s bad loan recoveries lifted sentiment, it does not materially change the fortunes of public sector banks

After a long while, state-owned bank stocks were the toast of the markets on Tuesday, with the Nifty PSU Bank Index rising 2.3% in the wake of Bank of India saying that it has hit pay dirt in loan recoveries.

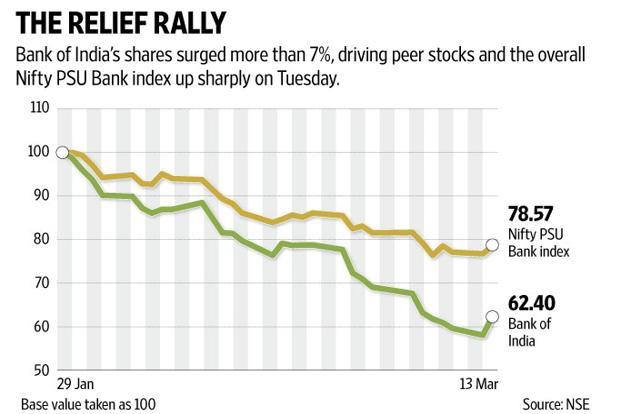

Public sector bank stocks have been hammered over the last four weeks after the debilitating $2 billion (Rs13,000 crore) fraud at Punjab National Bank (PNB) came to light in end-January. That, and the fact that Bank of India was put under the prompt corrective action plan by the regulator, a kind of an intensive-care unit, had dragged the lender’s shares by 44% so far in 2018.

But on Tuesday, senior Bank of India officials told television reporters that the lender has recovered loans close to Rs7,000 crore in the last two months and is hopeful of recovering another Rs2,000 crore by the end of the quarter. This was enough for investors to drive the bank’s stock up by more than 7%. Peer bank stocks benefited too.

A loan recovery of close to Rs9,000 crore is far from being chump change for the bank, especially since it has had no success in getting back money in the past. For instance, in the December quarter, Bank of India recovered about Rs1,178 crore but it had to write off Rs2,044 crore worth of loans. For more than four quarters now, the lender’s recoveries have been less than half of the amount it had to write off.

It is no wonder then that investors were relieved that recoveries for the lender have surged vis-à-vis past performance and more so from the fact that most of these were from the beleaguered letter of credit route of lending. Essentially, a standby letter of credit is a guarantee issued by a bank promising to pay the beneficiary. Another form of such guarantees were at the root of the fraud at PNB as other banks had lent to diamond tycoon Nirav Modi based on PNB’s letters of undertaking. Bank of India management has not elaborated whether the loan recoveries it has witnessed also included that from PNB’s fraud.

But while other public sector banks rose on Tuesday as the good news from Bank of India lifted sentiment for the group, this does not materially change the fortunes of these banks. Lenders still have to deal with a mountain of toxic loans that are lying in the form of cases with National Company Law Tribunal under the Insolvency and Bankruptcy Code. There is no clarity yet on how much PNB would make good the exposure of its peers through the fraudulent letters of credit linked to Modi. The tightening of bad loan recognition by the Reserve Bank of India earlier this year is expected to lead to a sharp rise in slippages for banks in the current quarter.

As for Bank of India, its goal is to reduce the proportion of its net bad loans to below 6% and get out of the regulator’s intensive care. This is a tall order, given that its net bad loan ratio is in the vicinity of 10%. Its recoveries are the fruits of its efforts towards fixing its balance sheet. But a decisive turnaround for the bank and its stock is not visible yet.